All Categories

Featured

Table of Contents

So it is not going to be some magic pathway to wealth. It will certainly help you make a little bit more on your money long-term. Of training course, there are various other advantages to any whole life insurance policy policy. There is the fatality benefit. While you are attempting to decrease the ratio of costs to death advantage, you can not have a policy with absolutely no survivor benefit.

Some individuals offering these policies say that you are not interrupting compound interest if you obtain from your policy instead than withdraw from your bank account. The cash you borrow out earns nothing (at bestif you do not have a wash lending, it may even be costing you).

A whole lot of the individuals that purchase into this principle likewise buy into conspiracy theory concepts concerning the globe, its governments, and its banking system. IB/BOY/LEAP is placed as a means to in some way prevent the world's economic system as if the globe's largest insurance companies were not component of its monetary system.

It is invested in the general fund of the insurance business, which largely invests in bonds such as US treasury bonds. You obtain a little bit greater rate of interest rate on your cash (after the first few years) and perhaps some possession protection. Like your investments, your life insurance coverage should be boring.

Concept Bank

It feels like the name of this concept changes once a month. You might have heard it described as a perpetual wealth strategy, family members financial, or circle of wealth. Regardless of what name it's called, boundless banking is pitched as a secret means to construct riches that just rich people learn about.

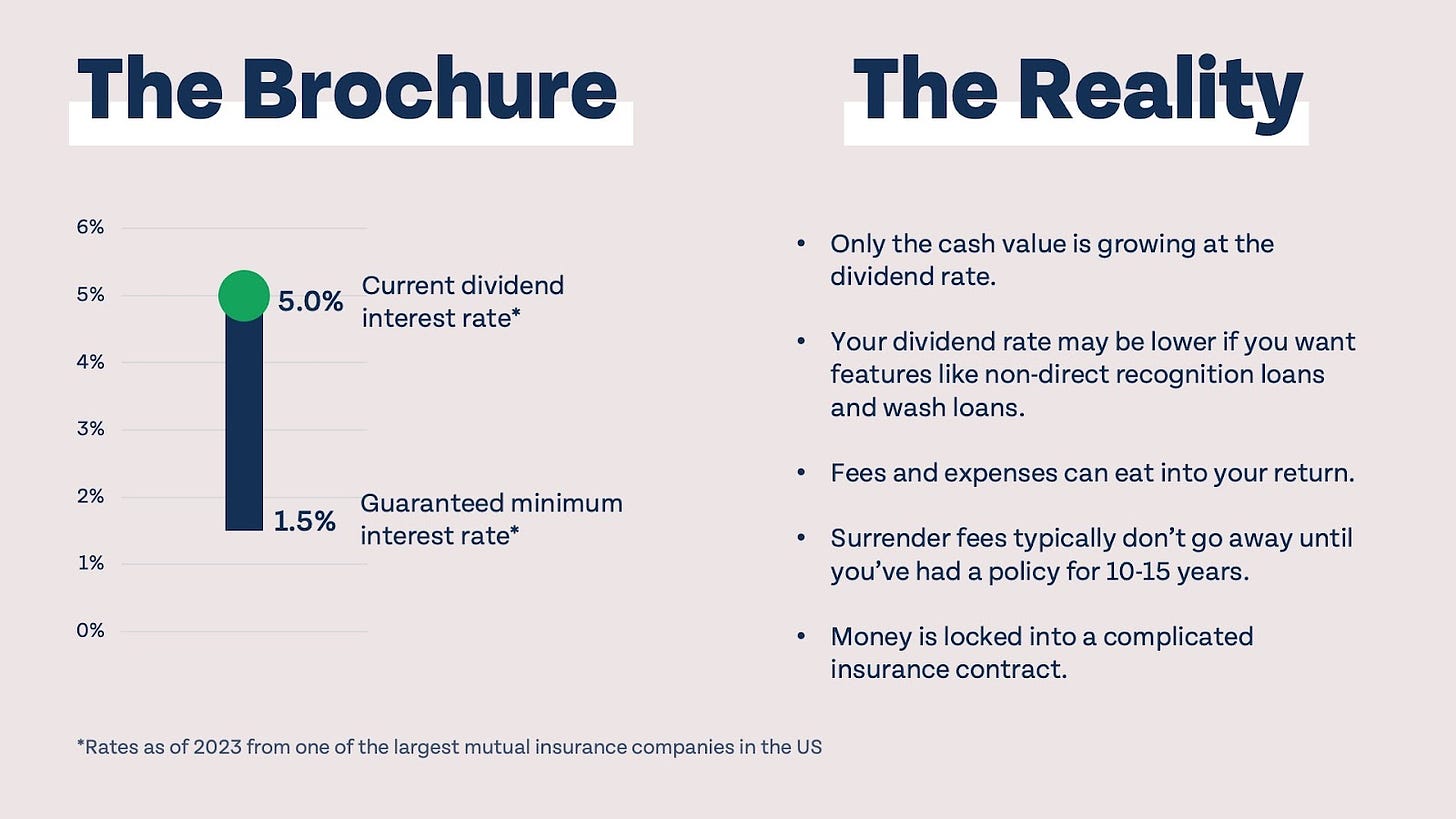

You, the policyholder, put cash right into an entire life insurance coverage policy via paying premiums and buying paid-up additions. This boosts the cash worth of the policy, which means there is even more money for the returns price to be related to, which typically indicates a higher rate of return overall. Returns rates at significant companies are presently around 5% to 6%.

Universal Bank Unlimited Check

The entire principle of "banking on yourself" just functions due to the fact that you can "bank" on yourself by taking finances from the policy (the arrowhead in the chart above going from whole life insurance policy back to the insurance holder). There are 2 various kinds of car loans the insurer may offer, either direct acknowledgment or non-direct recognition.

One attribute called "wash fundings" establishes the rates of interest on car loans to the exact same rate as the dividend rate. This suggests you can obtain from the plan without paying interest or getting rate of interest on the quantity you obtain. The draw of boundless financial is a returns rates of interest and assured minimum price of return.

The disadvantages of infinite financial are typically forgotten or not mentioned at all (much of the info offered about this principle is from insurance representatives, which might be a little biased). Only the money worth is expanding at the reward price. You also need to spend for the expense of insurance, costs, and costs.

Every long-term life insurance coverage plan is different, but it's clear somebody's total return on every dollar spent on an insurance policy product could not be anywhere close to the returns price for the plan.

Infinite Banking System

To give a really standard and theoretical example, let's presume somebody is able to earn 3%, on average, for every buck they spend on an "boundless financial" insurance coverage product (after all expenditures and costs). If we think those dollars would certainly be subject to 50% in tax obligations amount to if not in the insurance item, the tax-adjusted price of return could be 4.5%.

We assume higher than average returns overall life product and an extremely high tax price on dollars not place into the plan (which makes the insurance item look better). The fact for numerous folks may be worse. This pales in contrast to the long-term return of the S&P 500 of over 10%.

Infinite Banking Toolkit

At the end of the day you are purchasing an insurance coverage item. We like the security that insurance coverage supplies, which can be gotten a lot less expensively from an inexpensive term life insurance policy plan. Overdue loans from the policy may also lower your survivor benefit, diminishing an additional level of defense in the plan.

The concept just works when you not just pay the substantial premiums, but make use of added money to acquire paid-up additions. The opportunity price of every one of those dollars is remarkable exceptionally so when you can instead be investing in a Roth Individual Retirement Account, HSA, or 401(k). Even when contrasted to a taxable investment account and even a cost savings account, boundless banking might not offer comparable returns (compared to spending) and similar liquidity, access, and low/no cost framework (compared to a high-yield interest-bearing accounts).

When it comes to economic preparation, entire life insurance frequently attracts attention as a prominent option. Nonetheless, there's been an expanding pattern of advertising it as a tool for "limitless banking." If you have actually been checking out whole life insurance or have discovered this concept, you could have been told that it can be a means to "become your own bank." While the idea may seem enticing, it's critical to dig deeper to understand what this truly suggests and why viewing whole life insurance policy in this way can be misleading.

The concept of "being your very own bank" is appealing since it recommends a high degree of control over your finances. This control can be illusory. Insurance firms have the ultimate say in how your plan is managed, consisting of the regards to the loans and the rates of return on your cash money worth.

If you're considering whole life insurance policy, it's necessary to watch it in a broader context. Whole life insurance coverage can be a useful tool for estate planning, supplying an assured survivor benefit to your beneficiaries and possibly using tax advantages. It can also be a forced savings vehicle for those who battle to save money constantly.

Nelson Nash Institute

It's a form of insurance with a cost savings part. While it can supply consistent, low-risk growth of money worth, the returns are typically less than what you might achieve through other investment vehicles. Before leaping into whole life insurance policy with the idea of infinite financial in mind, take the time to consider your economic objectives, risk tolerance, and the full series of financial items readily available to you.

Unlimited financial is not a financial remedy. While it can function in particular situations, it's not without risks, and it requires a considerable commitment and understanding to handle efficiently. By identifying the prospective mistakes and recognizing truth nature of entire life insurance policy, you'll be better equipped to make an enlightened decision that supports your financial well-being.

This book will certainly show you exactly how to establish a financial policy and just how to use the financial policy to buy property.

Boundless banking is not a service or product offered by a details institution. Infinite financial is a technique in which you acquire a life insurance policy policy that builds up interest-earning cash worth and secure financings against it, "obtaining from on your own" as a resource of funding. Then eventually repay the financing and start the cycle all over once more.

Pay policy costs, a portion of which builds cash money value. Cash money value earns worsening interest. Take a loan out against the plan's cash worth, tax-free. Settle fundings with passion. Cash money value collects once more, and the cycle repeats. If you use this concept as meant, you're taking money out of your life insurance plan to acquire everything you 'd need for the remainder of your life.

Latest Posts

Infinite Banking Concept Wiki

How To Start A Bank

Bank On Yourself Whole Life Insurance